What does 2022 bring? Uncertainty

The US economy, with large fiscal deficits, has very low growth rates and does so with the support of a very expansive monetary policy. What is unprecedented is that the rate of investment does not seem to be altering.

- Análisis

After a 2021 with a smaller rebound than expected and with high commodity prices, a strongly negative real interest rate in the US, Great Britain, Europe and Japan, the year 2022 starts with great uncertainties. We will review the main global variables at play in the year and the repercussions this may have on Latin America.

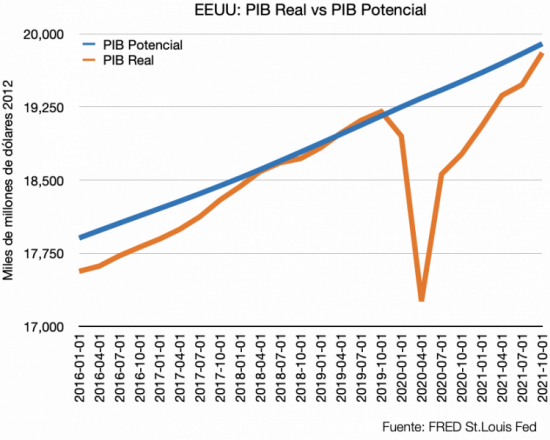

The US economy, with large fiscal deficits, has very low growth rates and does so with the support of a very expansive monetary policy that has been partially responsible for inflation in the world. What is unprecedented is that the rate of investment does not seem to be altering. The investment multiplier does not seem to be working and the half-yearly growth rate of private investment is negative compared to the immediately preceding half-year. The result is that economic growth has not yet returned to its projected long-term trend, which is potential GDP, as defined by the St Louis Fed.

The level of private investment before the 2008 crisis was in the neighbourhood of 20% of GDP, afterwards it stood at 17% and does not seem to be affected either by the negative interest rates of the whole decade, or by the injection of fiscal money, or by the abundant and generous infusion of credit from the Fed after 2009 until 2014 and again since 2020 to the financial system.

The current scenario is to see if a rise in interest rates and a cut in the M3 money supply will bring inflation down without drastically lowering economic growth, which is still insufficient. They have to reabsorb 6 trillion dollars to return to the level of liquidity in the system that existed before February 2020, according to the Fed's M3 data. A strong impact on US economic dynamics would mainly affect Mexico and Central America.

The pandemic has had an impact on production rates. The concept of just-in-time, which is vital for the globalised economy, was lost when, on the one hand, there was a sudden demand for consumer goods as a result of the possibility of going out to the streets to buy; on the other hand, because of the tax breaks for consumers in the US, basically. This meant that value chains starting in China ran into transport problems. Containers became scarce and ships began to queue up to enter saturated ports in the US, pushing up transport costs. On the other hand, factories that were closed started to produce and saw delays in the delivery of their inputs. This completes a picture where manufacturers are unable to produce productive goods (capital and intermediate goods), and producers of consumer goods are unable to produce final goods. On the other side demand is buoyant, with fiscal money, demanding delivery. The result of the above asynchronicity is inflation due to shortages of final consumer goods.

The inflation widely discussed in the OBELA must be kept stable, because it is not a matter of high consumption due to low interest rates alone, but for the other reasons mentioned. It should be remembered that the global drought that started in 2019 is an additional factor that will remain on food prices.

China apparently has a slowing growth outlook and is expected to grow at around 5.11 per cent in 2022, following 8 per cent growth in 2021. ASEAN 5 projects 5.8 per cent in 2022 (IMF) This keeps Asia as the world's leading growth and largest foreign trade volume. Shifting priorities towards its domestic market facilitates a stable recovery in an adverse global context. The consequence will be that demand for electric cars and electric mass transit vehicles will continue to rise with the effect on the market for copper and other metals.

A sign of uncertainty is that the range of US growth projections by the Fed, gathered from all those who make economic growth projections, ranges from 3.1 to 4.9% in 2022, probably 3.8%, according to FMOC Summary of Economic Projections, December 15, 2021.

In sum, 2022 brings high inflation, low growth, greater uncertainty about growth, and a further eastward economic shift in global economic dynamics. This will bring more conflict between the US and China and more conflict over China's role in Latin America. It begins with tensions between the US and Russia in Ukraine over the presence of NATO, with the direct effect on oil and gas prices and the threat of NATO break-up. Tensions between China and the US over China's presence in Latin America in the telecommunications and clean energy sectors; and tensions within NATO over US geostrategic interests in Ukraine. The year of the tiger will be a difficult year for Latin America.

Oscar Ugarteche: Institute of Economic Research, SNI/CONACYT, OBELA coordinator.

Del mismo autor

- El multilateralismo bipolar 08/03/2022

- Bipolar multilateralism 07/03/2022

- What does 2022 bring? Uncertainty 31/01/2022

- ¿Qué trae el 2022? Incertidumbre 31/01/2022

- The most expensive Christmas of the century... (so far) 20/01/2022

- La navidad más cara del siglo (hasta ahora) 20/01/2022

- Lo que pasó en el 2021 10/01/2022

- What happened in 2021 10/01/2022

- Estados Unidos: el elefante en la habitación 08/11/2021

- The elephant in the room 07/11/2021